Understanding Mortage Rates

buyers Brad Cohen January 11, 2024

buyers Brad Cohen January 11, 2024

Have you been considering buying a home in the Harrisonburg, VA area? Well, we've got some exciting news for you! Recent developments in the mortgage market are making homeownership dreams more attainable than in recent history.

If you've been keeping an eye on mortgage rates, you'll be pleased to know that rates for 30-year fixed mortgages have significantly dropped since the end of October 2023, currently standing at under 7%. This trend downwards is a breath of fresh air for potential homebuyers, as it eases the housing affordability squeeze.

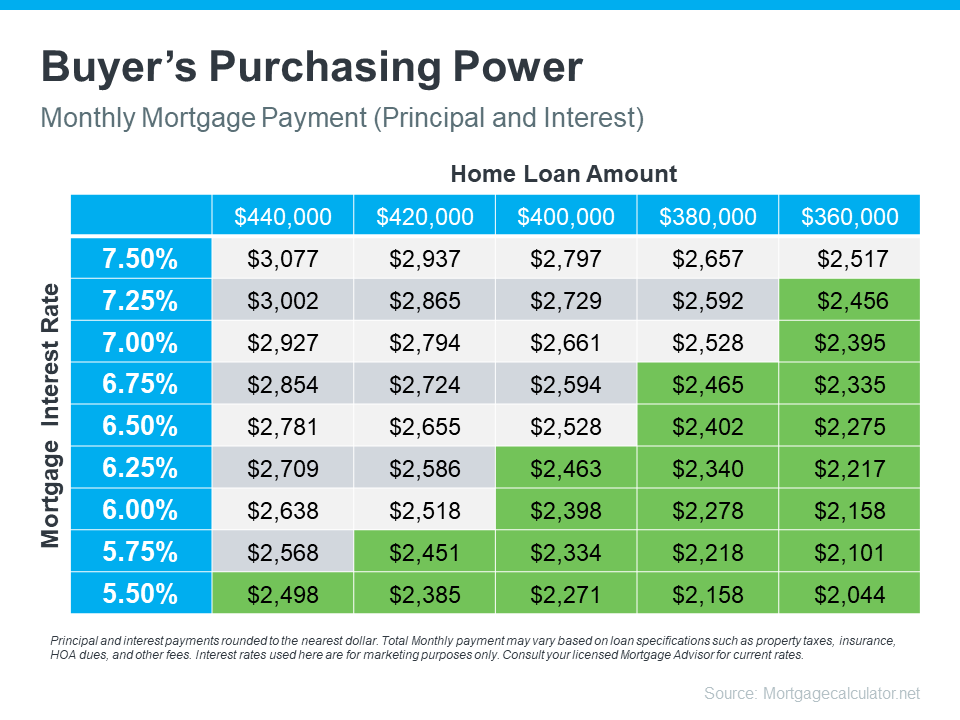

Understanding the relationship between mortgage rates and your monthly home payment is crucial. Even small changes in rates can have a significant impact on your budget and the loan amount you can afford. The chart below illustrates how your ability to afford a home, changes with shifting mortgage rates. To navigate this landscape effectively, it's essential to seek guidance from reliable local real estate agents and lenders.

As you delve deeper into the housing market, you'll encounter discussions about inflation and decisions made by the Federal Reserve (the Fed). The Fed's primary goal is to lower inflation, and to achieve this, they have been raising the Federal Funds Rate. While this doesn't directly dictate mortgage rates, it has an impact.

Recent developments indicate a positive shift, with inflation cooling and the Fed's rate hikes becoming smaller and less frequent. In fact, there haven't been any increases since July. According to the New York Times, the Fed has left interest rates unchanged and even signaled potential rate cuts in 2024, indicating confidence in economic improvement.

Inflation and the Fed's actions play a significant role in influencing mortgage rates. With the Fed pausing rate hikes and considering cuts, there's a strong indication that mortgage rates will continue their downward trend in 2024. This not only improves affordability for buyers but also provides sellers with more flexibility in their decisions.

If you're on the verge of buying a home in Harrisonburg, VA, the recent downward trend in mortgage rates is excellent news for your plans. By staying informed and seeking expert advice, you can navigate the market dynamics effectively. Now is the time to connect, plan your next steps, and turn your homeownership dreams into reality.

Winter Staging Tips

Debunking the "Wait for Spring" Myth

homeowner

Festive, fun, and actually useful ideas for the freshly moved-in crowd

buyers

Honoring Veterans This November

2025

Make It Yours in Phase 2

Ready to buy, sell, or invest in Virginia real estate? Reach out to our experts today to start a conversation. We're here to help.